Make Better Credit Decisions with

Highest accuracy in the market

Approve More, Confidently.

With an over 20-point gain in GINI, you’ll start saying “yes” to more customers and still have a lower loss rate.

Customise high quality scorecards yourself with full access to algorithms matched to your unique use cases.

creditX’s high accuracy means reduced risk, letting you to lend to new segments or markets confidently.

FASTEST TIME-TO-VALUE

Start Lending Better in Shorter Time

With credit scorecards developed this fast, you’ll always be up-to-date to make the most informed decisions.

Credit models are built and deployed in a snap, so you can make the right calls more quickly and more often.

creditX plugs and plays fast with APIs. There’s no tedious onboarding process and it’s ready to score when you are.

SIMPLY EASY TO USE

Credit Modelling, Made for Anyone

Powerful AI meets simple UI. No coding experience is needed to validate, build or deploy powerful scorecards.

creditX shaves weeks off any data scientists’ time building each scorecard, allowing focus on critical tasks

With our plug-and-play APIs, our creditX AI solution fits right into your existing workflows within weeks.

Fair, Transparent & Explainable AI

Ensuring Regulatory Compliance & Security

is priced affordably for big banks, startups and all lenders in between

How  Works

Works

Build Rapid, Custom Scorecards AI-tomatically

Powerful proprietary AI that leads the industry in speed, precision and functionality. All in a simple, affordable platform anyone on your team can use.

Connect Your Data with our Platform

Internal

Data

External

Data

Alternate

Data

Automatically Builds, Validates, and Deploys Your Credit Scorecards

Application

Behaviour

Collection

One-click Deployment of Your Custom Scorecards, Instantly

Data Ingestion

- Connect to any data source

- Automated data validation

Data Treatment

- Transformation, standardization & hot encoding

- Bias Reduction

Feature Engineering & Variable Selection

- 100+ auto-derived variables

- Identify non-linear patterns

- ML boosted & correlation-based variable selection

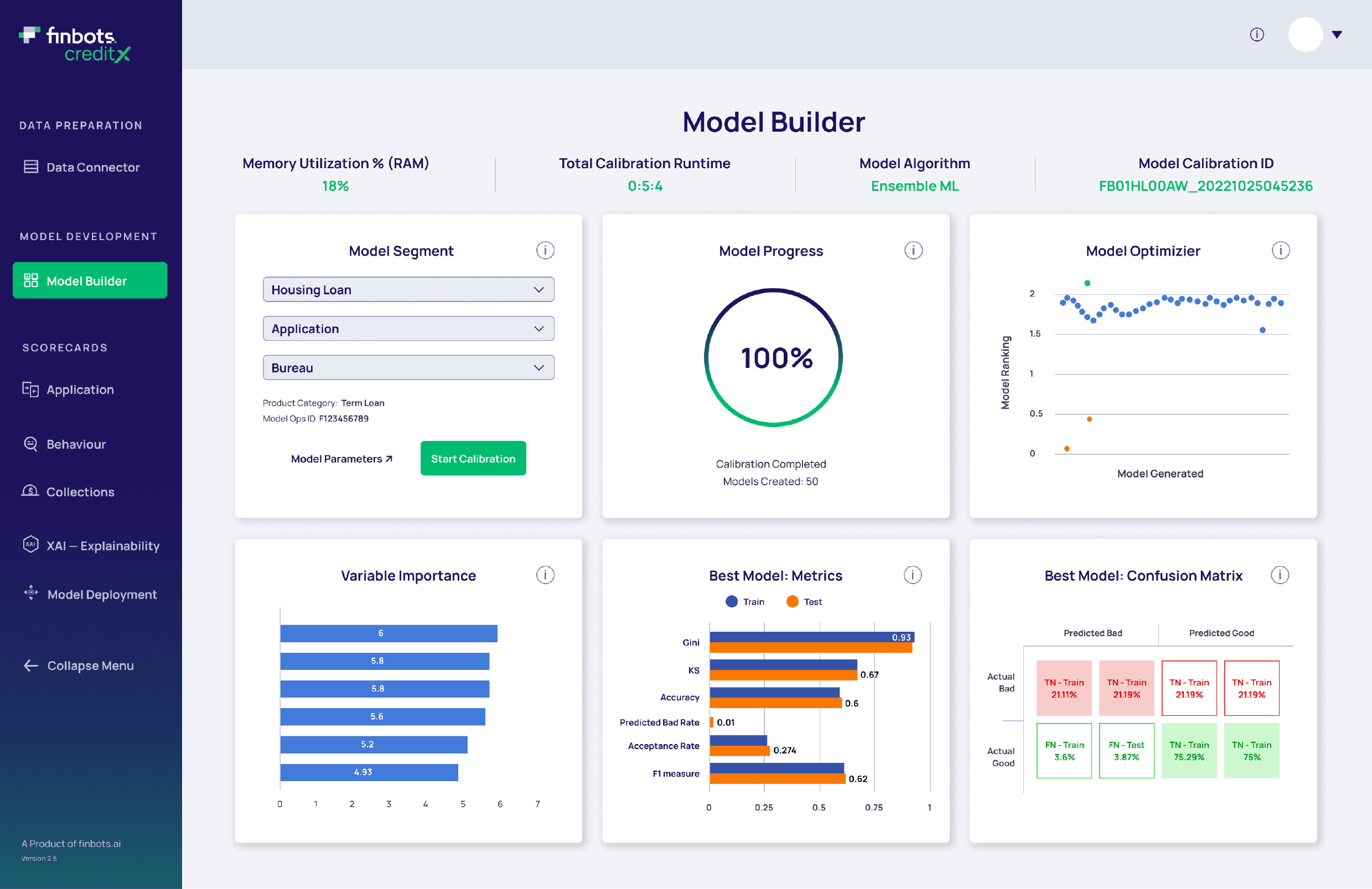

Model Builder

- Set your model parameters

- Generate new models or change PD levels to see model impact

Model Validation & Explainability

- Cross-validate models with trained & testedframe works

- Advanced Explainability: Model & Decision

Model Deployment & Monitoring

- Single-click, API-based deployment

- Real-time decisioning

- Monitor performance with analysis & reports

Data Ingestion

Data Treatment

Feature Engineering & Variable Selection

Model Builder

Model Validation & Explainability

Model Deployment

1 Day

1 Day

Other solutions (9-12 Months)

Connect Your Data with our Platform

Internal

Data

External

Data

Alternate

Data

One-click Deployment of Your Custom Scorecards, Instantly.

How  Works

Works

Build Rapid, Custom Scorecards AI-tomatically

Powerful proprietary AI that leads the industry in speed, precision and functionality. All in a simple, affordable platform anyone on your team can use.

Connect Your Data with our Platform

Internal

Data

External

Data

Alternate

Data

Automatically Builds, Validates, and Deploys Your Credit Scorecards

Application

Behaviour

Collection

One-click Deployment of Your Custom Scorecards, Instantly

Data Ingestion

Data Treatment

Feature Engineering & Variable Selection

Model Builder

Model Validation & Explainability

Model Deployment

1 Day

1 Day

Other solutions (9-12 Months)

Connect Your Data with our Platform

Internal

Data

External

Data

Alternate

Data

One-click Deployment of Your Custom Scorecards, Instantly.

is trusted by